The 1st Five SAP PPM Enhancements for Capital Portfolio Management

And the ones you need to migrate to S/4HANA.

If you are implementing SAP PPM for Capital Portfolio (Capex) Management, there are five enhancements that every Capex PPM implementation will need.

Four of these should be upgraded to S/4HANA. One should not. Find out why.

Here they are:

1 - Portfolio Item Numbering

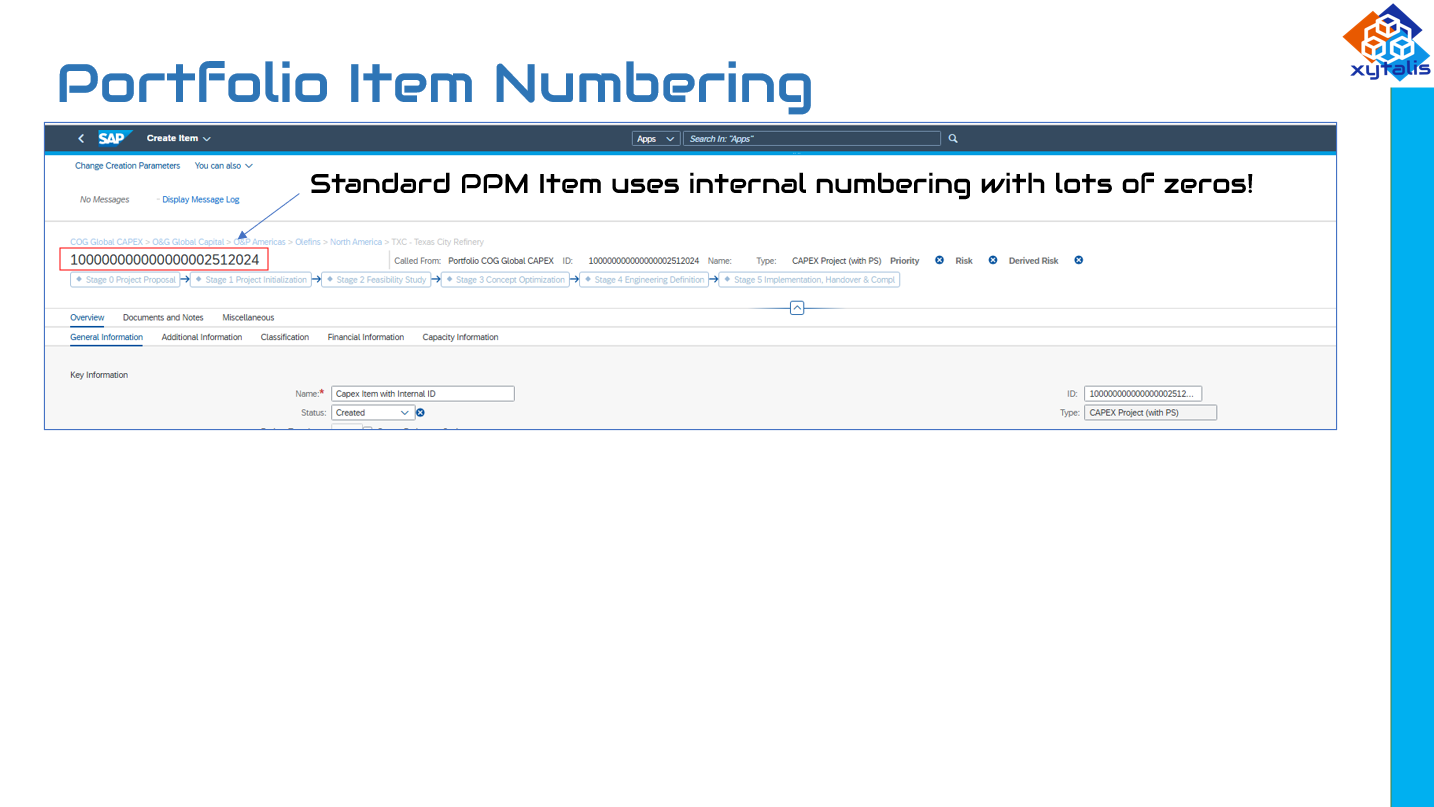

Standard PPM Portfolio Item numbers are internally generated and consist of a lot of zeroes.

SAP PPM Item Number - default numbering

Fortunately SAP provides an enhancement!

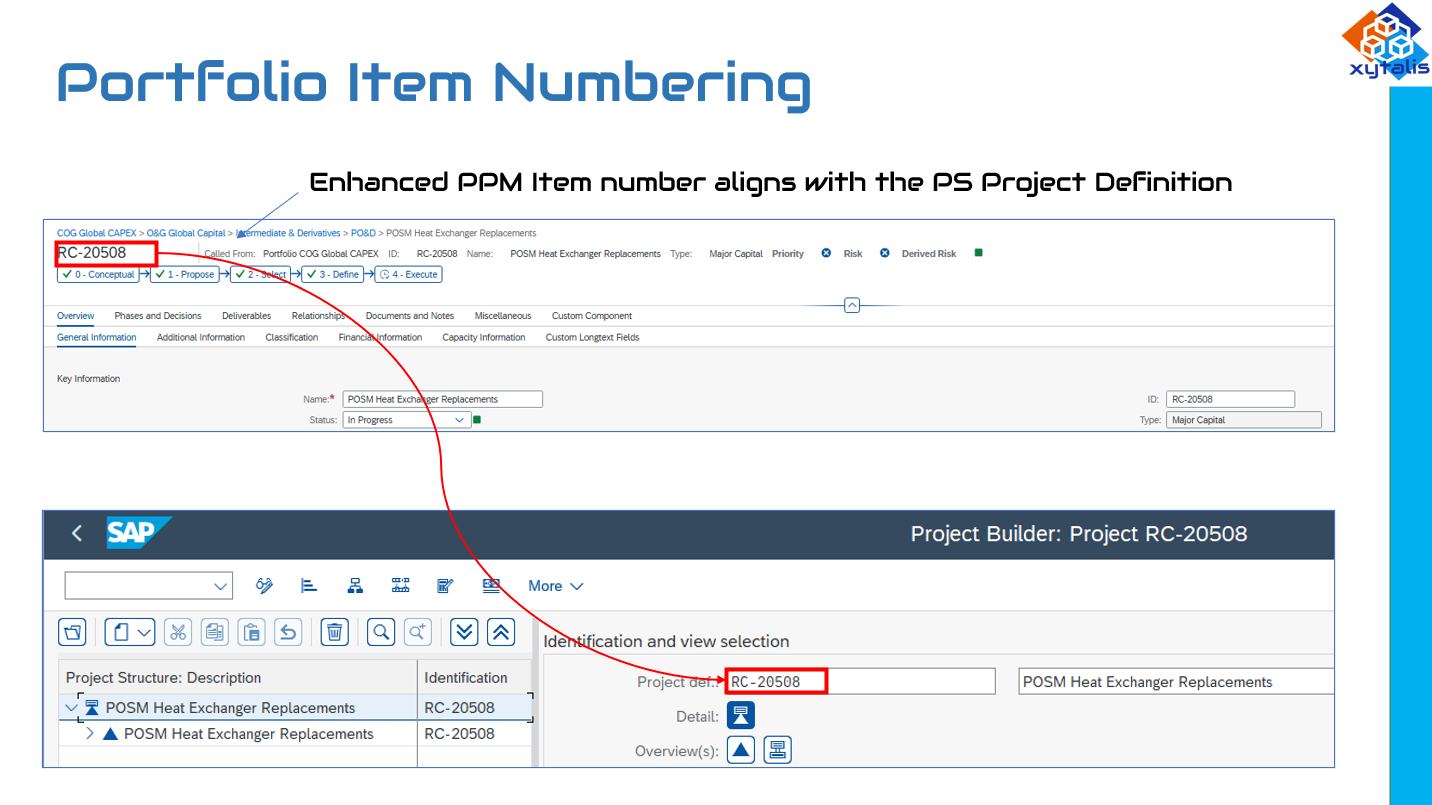

For Capex PPM projects, we typically want to replicate the PS Project Definition, and then have that number persist throughout the project ecosystem. This can include PPM Project Management, Primavera P6 Project Management and any other applications.

Things can get a bit more complicated if you need to find the next available PS Project Definition and use that to assign to the item. For customers that implemented the PS module prior to PPM and who still manually create some projects directly in ECC/S4, determining the next available project definition will be required.

Fortunately, SAP provides a nice custom numbering enhancement that can be linked to the PS Project Definition.

2 - Project Creation

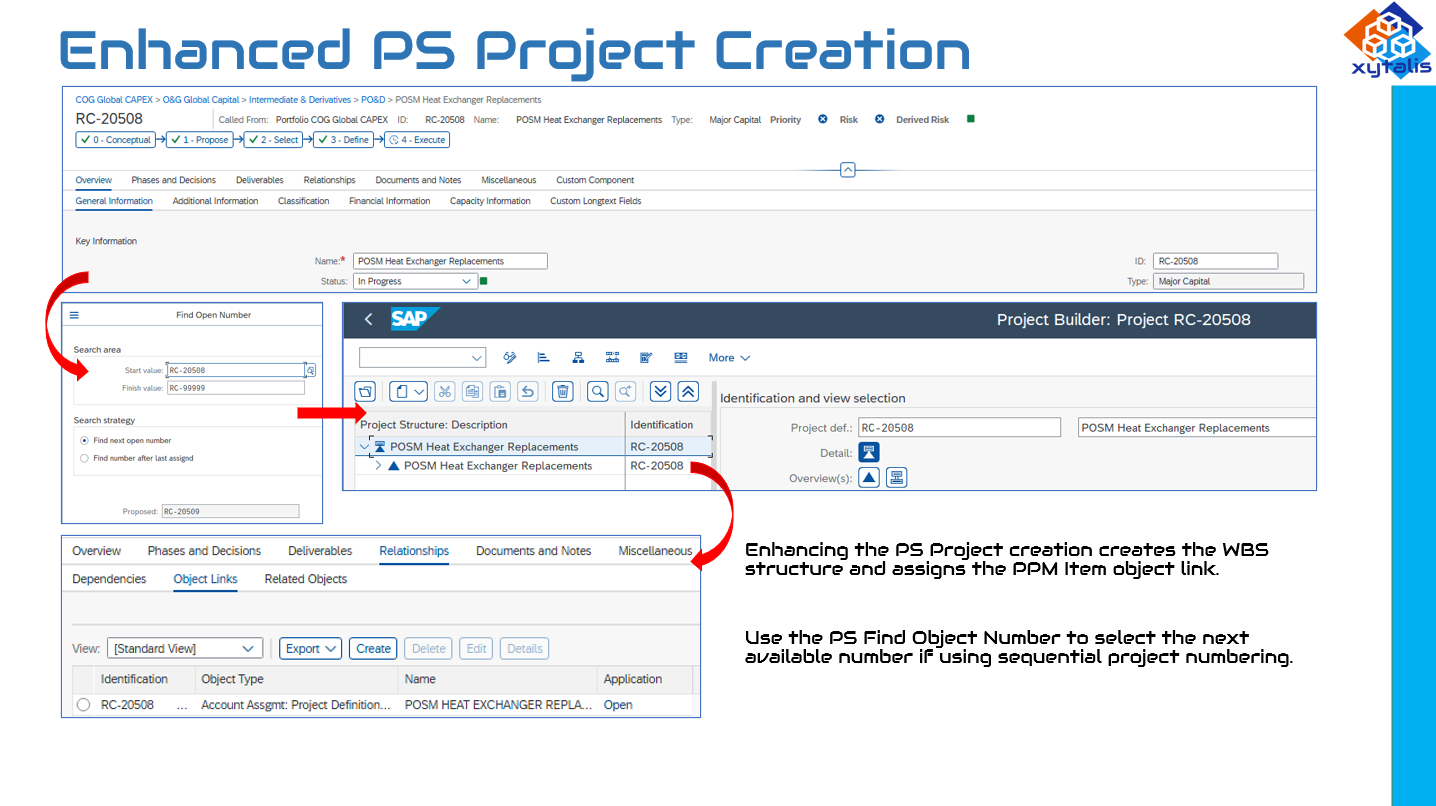

SAP PPM has standard PS Project Definition creation, however if you use PPM to create a project in the Project Management module then you don’t get the option to create the PS Project as well. You will need to enhance SAP to create the PS Project, using the PS Project Definition number discussed above. Use an operative project template to populate the WBS structure or just create the high level WBS and manually populate it. You can use Decision Flow Management (DFM) to push the number, description and other fields to the WBS elements.

SAP also provides the option to create a WBS structure from the PPM Project Management structure. This is called Accounting Integration and is not covered by this post as it is not typically applicable to capital projects.

Create the PS Project Directly from the PPM Item

3 - Item Custom Fields

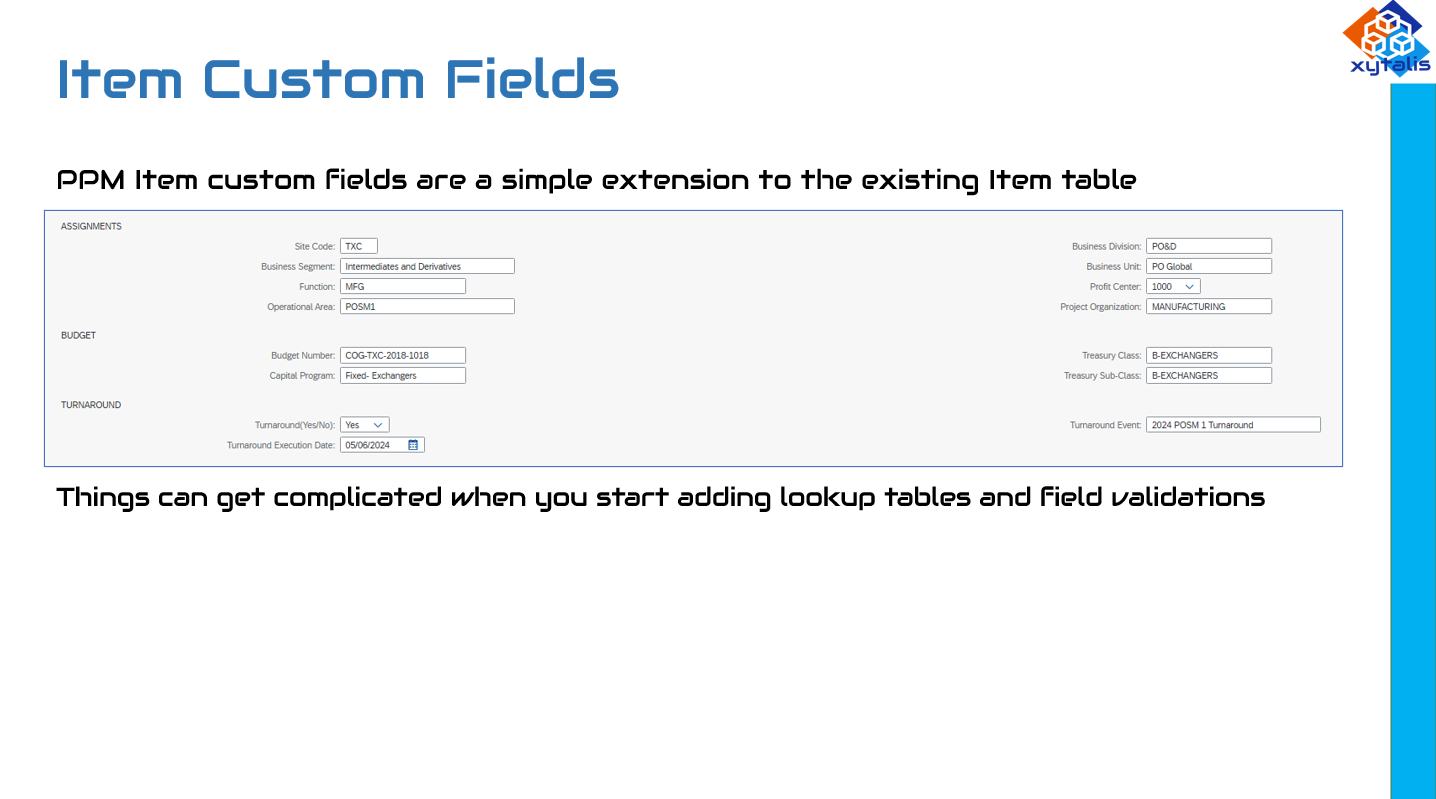

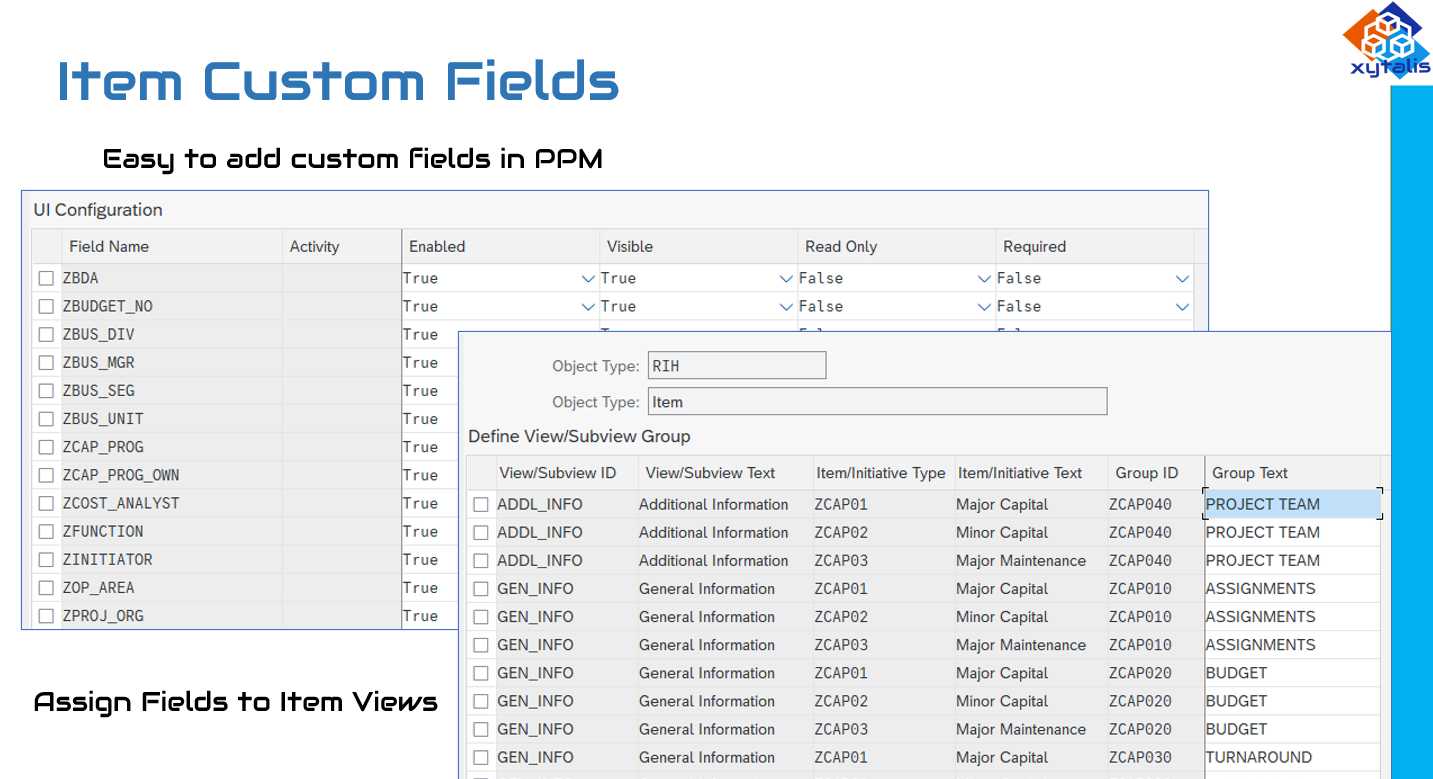

The PPM Item includes several fields as standard, but customers always need to add their own. Now you definitely do not want to go overboard here – and many companies do – but a few important custom fields are a smart addition. Fortunately, it is easy to add customer specific fields as extensions to the Portfolio Item table, but things get complicated when you start adding lookup tables and relationships.

Portfolio Item Custom Fields are easy to define and add

Custom fields can be added to the Item Header or the Decision Point with most customers adding the fields to the Item header and syncing them with the PPM Project, the PS WBS elements and other objects such as the Primavera P6 Project Header / WBS via DFM (Decision Flow Management).

Standard field controls allow custom fields to be added to any Item screen.

4 - Financial Integration

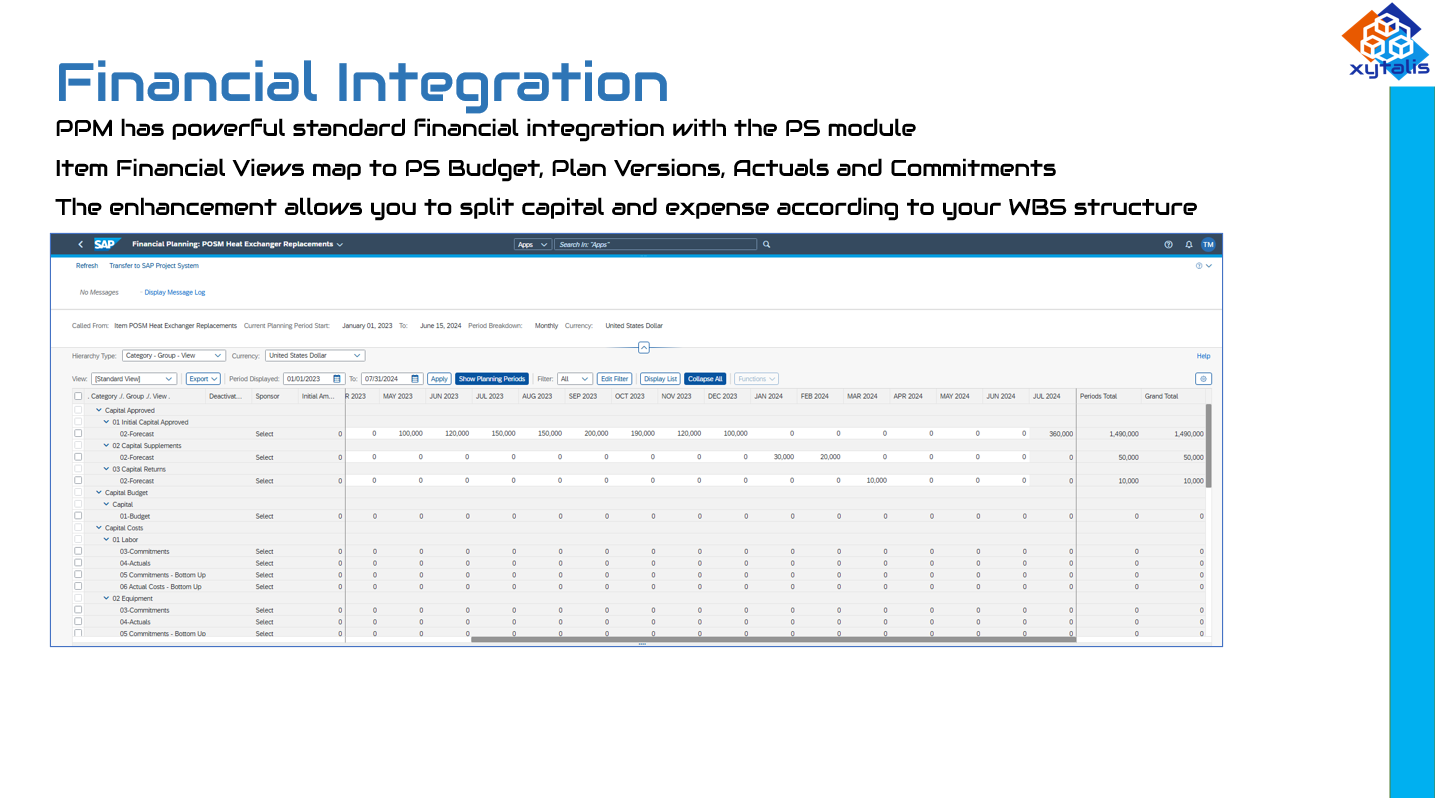

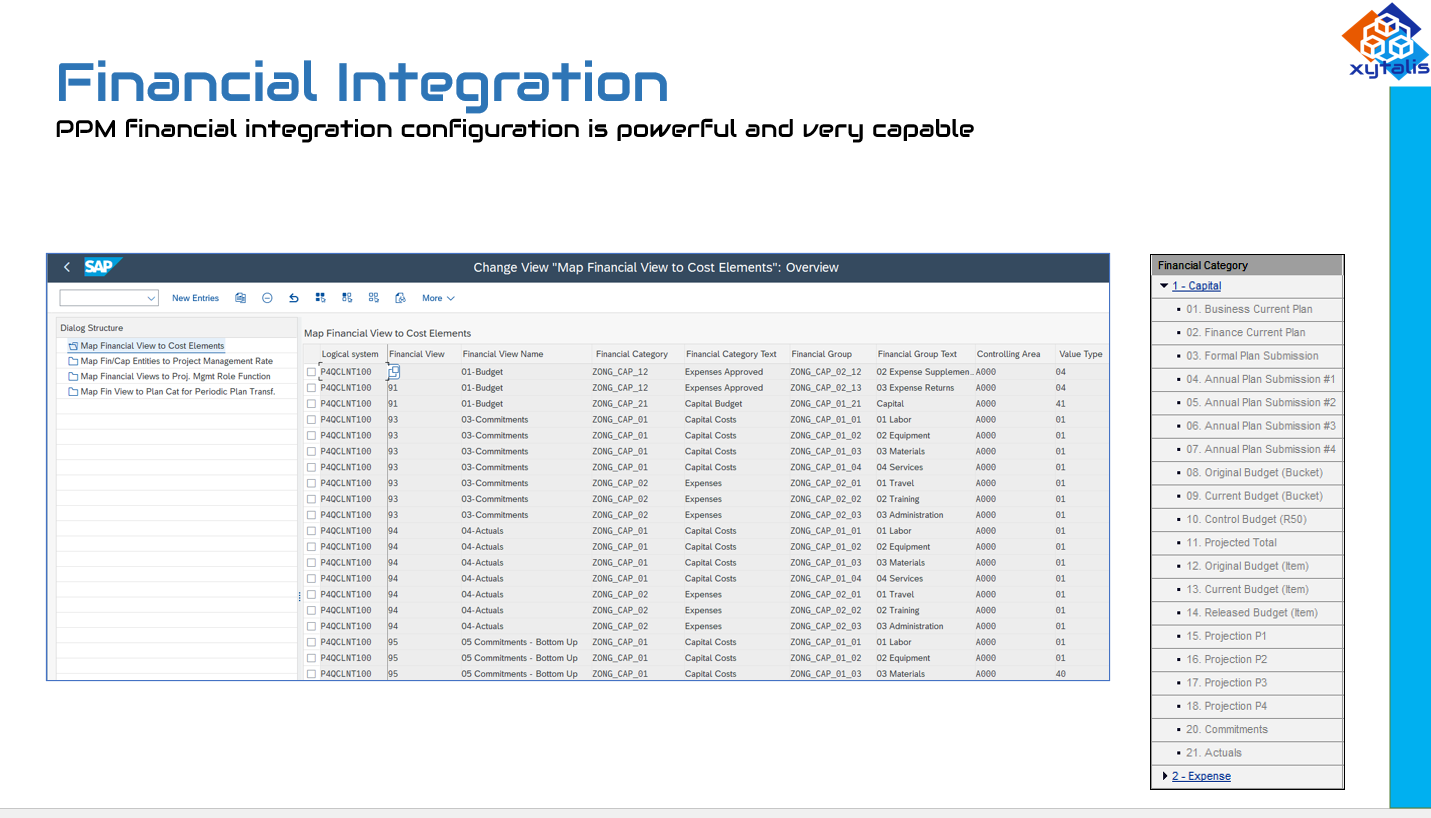

PPM Financial Integration covers the integration between PPM and PS and is in two parts.

Part 1 is the distribution of budget and planned costs from the PPM Financial Views to the PS WBS Element Budget and Plan Versions. The level at which customers split capital and expense costs vary according to their individual process, with some customers defining this at the level 1 WBS while others choose the level 2 or level 3 WBS to differentiate capital from expense.

PPM Financial View configuration is extremely flexible

All capital PPM solutions have a combination of capital and expense cost categories and the distribution of these capital and expense costs to the appropriate WBS elements needs a little customization. SAP provides the hooks to do this, but light development is required.

In addition to the distribution of budget from the PPM Item to the PS WBS elements, there is also the need to distribute planned costs from PPM to PS as part of the annual planning and budgeting process; and to push costs up the structure from the WBS element to the PPM Item when aggregating project plan version values that are desired at the portfolio level. Two examples of this are detailed cost forecasts and approved scope changes. This is the second part of the integration.

SAP has done a great job designing the PPM Financial Categories, Groups and Views to the point where many customers and even consultants fail to get the maximum benefit from it. Separating Capital and Expense is normal, as is differentiating Internal costs from external. But with some creativity you can display detailed cost forecast information (EAC, ETC, EV, etc) and even Net vs Gross budget and plan when dealing with the Joint Venture Accounting (JVA) business requirement found in Upstream Oil & Gas.

Whilst standard PPM financial integration is very capable of transferring budget and costs from PPM to PS and back to PPM, with a little bit of creative enhancement you can turn financial integration into a powerful tool.

PPM Financial Views can support Joint Venture Accounting (JVA) and Earned Value (EV) Management

5 - Capital Project AFE Approval

The four enhancements discussed previously are all relatively simple to develop with low complexity and development cost, however the fifth and final enhancement we will discuss here is high complexity and high cost. It is the capital approval process. This process consists of:

Selecting the project to be submitted and populating all the prerequisite approval fields and values

Generating an approval request form and submitting the capital request for approval

Determining the correct approval routing depending on variables such as location, type of project and amount of budget

Generating and sending an email to the approver as well as interested parties, including context-specific text

Approval and rejection processing

Final approval and budget distribution / supplementation / release to the appropriate WBS elements

Supporting approval reports

AFE Approval is a Critical Component of any Capex Portfolio Management Solution

Each enhancement requires its own code whilst being integrated into an end-to-end process that can be repeated multiple times if the project is a multi-year, multi-phase project with incremental funding requirements. Typically the fields required to support the capital approval process are defined during the custom field definition, and the budget funds transfer and distribution are included in the financial integration scope, but the process initiation, form generation and digital signature, the delegation of authority, email routing and approval / rejection actions all involve significant customization.

The AFE Approval Enhancement is Complex, with Many Parts. Look for Partner Alternatives

S/4HANA Upgrade Impact

At the time of writing this post only one third of SAP customers had upgraded to S/4HANA. Many SAP PPM implementations were completed a long time ago and include highly specific and customized enhancements that should be assessed for inclusion with any pending upgrade to S/4.

Of the five enhancements listed above, we see the first four as being must-haves in any future S/4HANA capital portfolio management solution. The fifth and final enhancement of the list – Capital Project AFE Approval is absolutely required however we do not recommend you develop a custom solution in S/4.

Why? Because you must consider your S/4 upgrade as the one and only opportunity to clear your SAP environment of bespoke custom development.

Consider buying an SAP-certified partner solution instead.

The future of SAP is the clean core, so be laser-focused on that. Falling-back to old habits (we’ve always done it that way, this is a competitive advantage, etc, etc) is a sure way to get yourself into trouble in the next few years.

Every single enhancement you make to SAP must pass the highest level of scrutiny, as they could become significant drags on your company in the years to come. 5 years from now AI will be a game-changer, especially in transaction heavy systems like ERP.

AI will vary from simple efficiency bots (create me a sales order for XYZ consisting of ABC…) to bot front-ended machine learning mega tools (pull all the new equipment items from the latest project P&ID, assign them a tag# according to unit & equipment type, create the FLOC and Equipment Master in Inactive status and make a call to the supplier of the equipment to grab the drawings, spec sheets, spare parts lists, maintenance schedule and set up the all the objects in SAP and activate them once the project is completed) to lots of other capabilities it will be hard to get our heads around!

AI will harm lagging companies more than any other technology, so please don’t inadvertently harm yourself by sticking to old processes inherited from previous generations of your company.

Avoid Developing a Custom Capital Approval Workflow Enhancement in S/4HANA. Look for Partner Solutions Instead.

Summary

There are many other enhancements we can make for Capital Portfolio Management using SAP PPM. However, these five are typically the first five and therefore most important ones that customers need.

One of these enhancements should not be developed in S/4HANA. We have explained the rationale above.

If you are running SAP PPM and are in the process of upgrading to S/4HANA or are considering it, do get in touch with us. We offer a free, no-pressure one hour consultation with our experts that have over 30 years combined SAP PPM Implementation experience, including multiple S/4HANA projects.

Click the link and fill-in the form and we will be in touch. https://www.xytalis.com/consult

If you have any questions or comments, please add them in the comments section below.